Please use this form to set up RRSP's/RESP's/TFSA's/FHSA's & LIRA Investments. Do not use this form if you are applying for the Investment Loan Leverage strategy.

PERSONAL INFORMATION

EMPLOYMENT AND NET WORTH

BENEFICIARIES

INVESTOR PROFILE QUESTIONS

The questions in this investor profile questionnaire were designed to help you understand your investment objectives and your investment personality. You may use this service to support your investment-making decision or to select an allocation tailored to your needs. As you answer the following questions, remember there is no right or wrong answer. However, keep in mind that you must be completely candid, or the results won’t reflect your true investment personality. Please answer each question and find your score in the box next to each answer. Your total score will help you define your investment profile. If you have more than one account, please consider filling out one questionnaire for each account. Each account you hold may have a different purpose, which may affect your investment decisions.

INVESTMENT HORIZON

REASON WHY WE ARE RECOMMENDING THIS STRATEGY

The applicant would like us to manage their portfolio to take advantage of the professional management offered by pooled investments while benefiting from the capital protection offered by the insurance company. To this end we have recommended the segregated fund and have explained the risks involved. The applicant has agreed that this route is one that fits their investment goals. We will invest the funds according to their investor profile.

ADVANTAGES OF WORKING WITH US

SIMPLICITY

With your advisor, you can determine which portfolio best suits your needs based on your investor profile.

You need not worry about choosing funds within the portfolio; these are selected by the portfolio manager based on the markets and their economic outlook.

Periodic review to maintain the allocation of your investment portfolio and in keeping with your risk tolerance.

EFFECTIVENESS

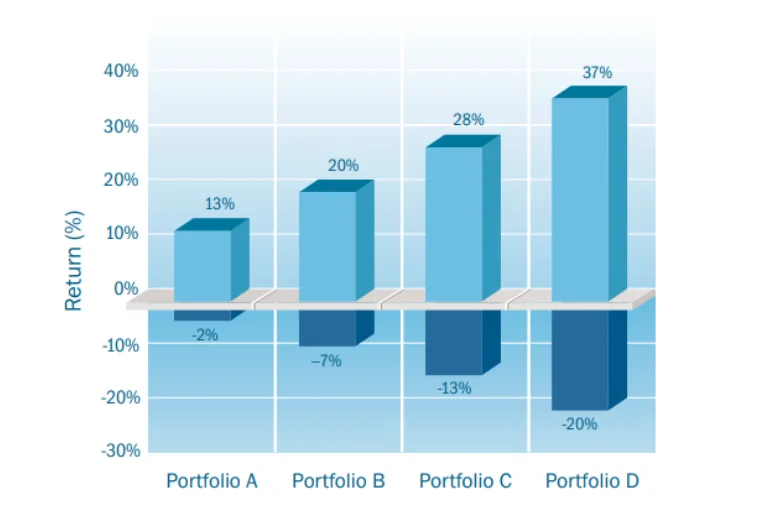

Growth with less volatility, thanks to a diversification of asset classes, managers, management style, geographies and economic sectors.

Access to multiple quality funds.

Expertise of renowned fund managers

ACKNOWLEDGEMENT

I hereby acknowledge that the above investment risk stance is consistent with my investment risk requirements and profile. Before making any investment decision, I will fully understand the product risks and features in order to determine that my investment decision is consistent with my investment objectives, risk-appetite and financial resources.